Prime cost method depreciation formula

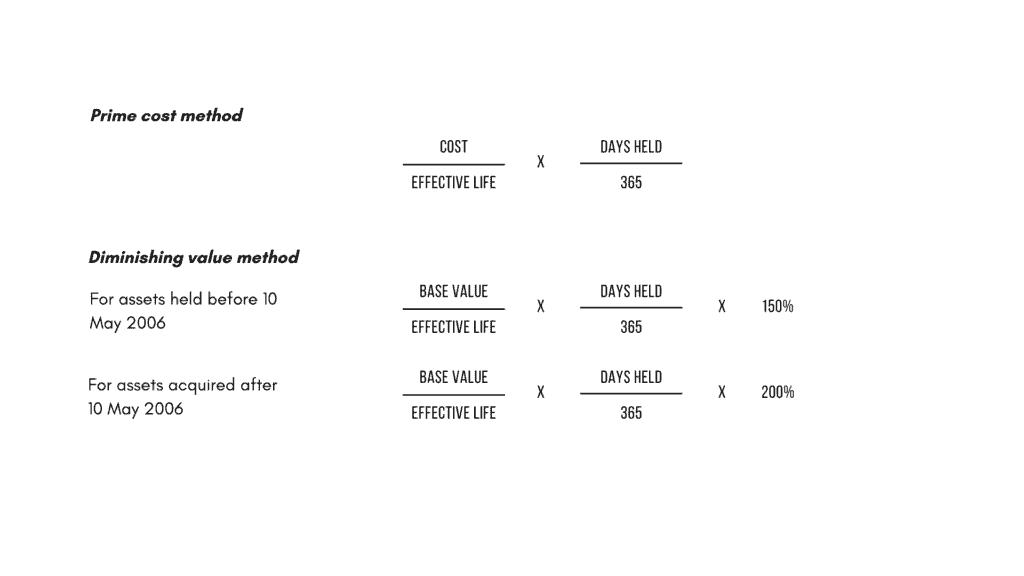

Cost of asset x days held 365 x effective life of asset 100 percent If an asset costs 100000 and has a ten-year useful life you may deduct 10 of. Under the prime cost method also known as the straight line method you depreciate a fixed amount each year based on the following formula.

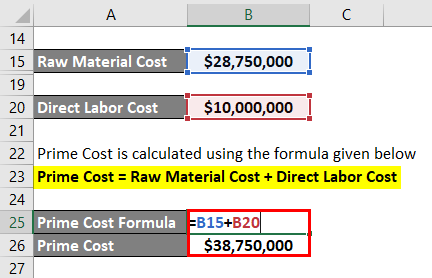

Prime Costs Definition Formula Explanation And Example Wikiaccounting

Prime cost Direct raw materials Direct labor textPrime cost textDirect raw materials textDirect labor Prime cost Direct raw materials Direct labor.

. To calculate depreciation you can generally use either the prime. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. The following is the prime cost formula.

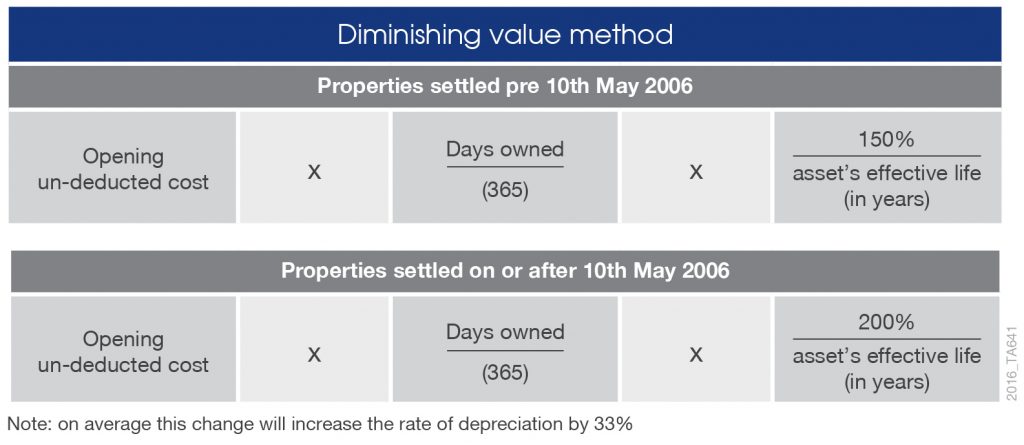

The DB function performs the following calculations. Opening un-deducted cost days owned 365 100 assets effective life in. This method assumes the life of a vehicle in order to calculate either prime cost or Calculating depreciation.

The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life. Prime cost straight line and diminishing value methods In most cases you can choose to use either. Fixed rate 1 - salvage cost 1 life 1 - 100010000 110 1 -.

It uses a fixed rate to calculate the depreciation values. Prime Cost Depreciation Method This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following. View Depreciation Methodsdocx from BUSINESS 5912 at Academies Australasia College.

If the cost of an asset is 50000 with an effective life of 10. Business vehicle depreciation is a Prime cost. The formula for calculating depreciation using the prime cost method is as follows.

The general depreciation rules set the amounts capital allowances that can be claimed based on the assets effective life. Assets cost days held365.

Prime Cost Formula Calculator Examples With Excel Template

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Cost Meaning Formula Calculation Examples

Diminishing Value Vs The Prime Cost Method By Mortgage House

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Prime Costs Meaning Understanding Example The Difference Between Prime Costs And Conversion Costs Limitations Of Using Prime Cost Commerce Achiever Commerce Achiever

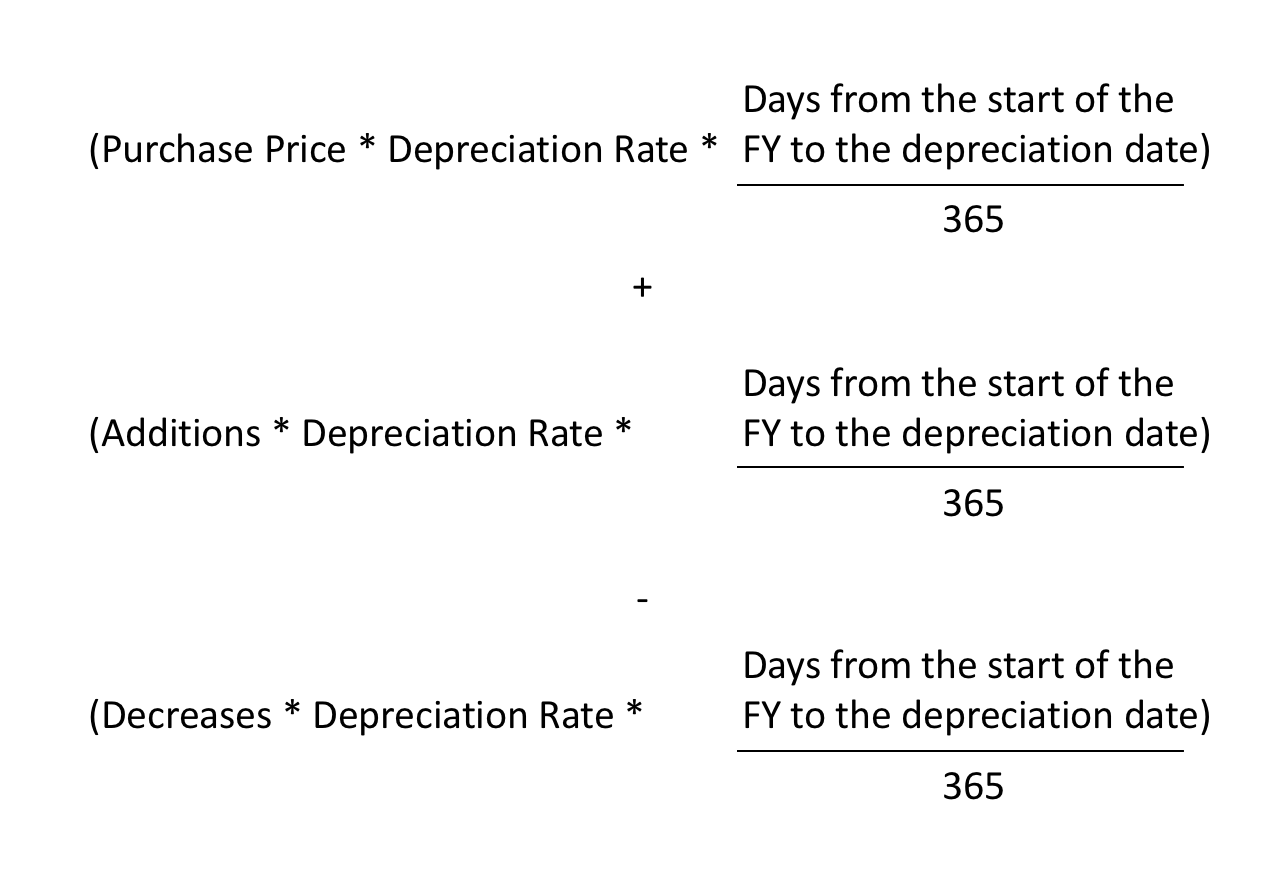

Recording Depreciation Part Way Through The Year Simple Fund 360 Knowledge Centre

8 1 Copyright 2010 Mcgraw Hill Australia Pty Ltd Powerpoint Slides To Accompany Croucher Introductory Mathematics And Statistics 5e Chapter 8 Depreciation Ppt Download

Working From Home During Covid 19 Tax Deductions Guided Investor

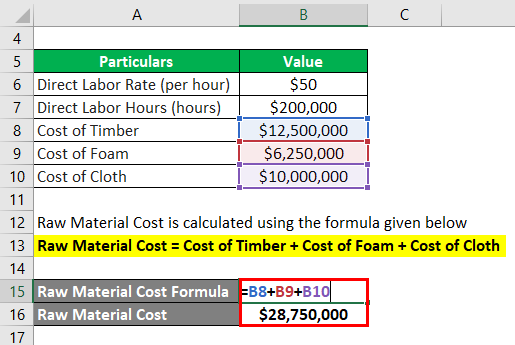

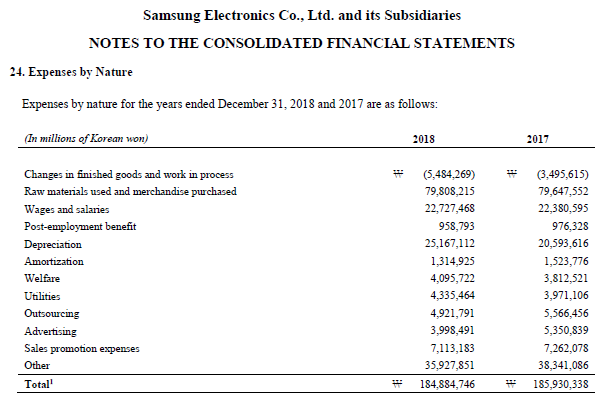

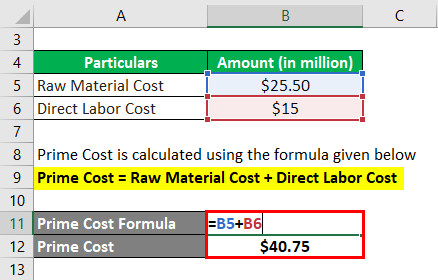

Prime Cost Formula Calculator Examples With Excel Template

Prime Cost Formula Calculator Examples With Excel Template

Prime Cost Formula Calculator Examples With Excel Template

Diminishing Value Vs The Prime Cost Method By Mortgage House

Prime Cost Formula Calculator Examples With Excel Template

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

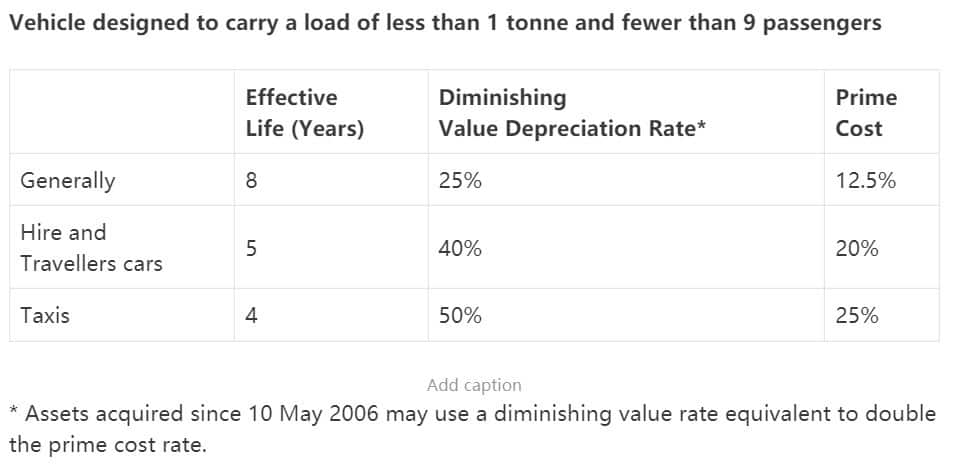

Depreciation Of Vehicles Atotaxrates Info

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors